The 2023 autumn budget announced changes to the R&D tax credit scheme for accounting periods beginning on or after 1 April 2024. The current schemes will be replaced by a merged scheme for all companies and an SME intensive scheme for companies that conduct a lot of R&D.

Summary of relief

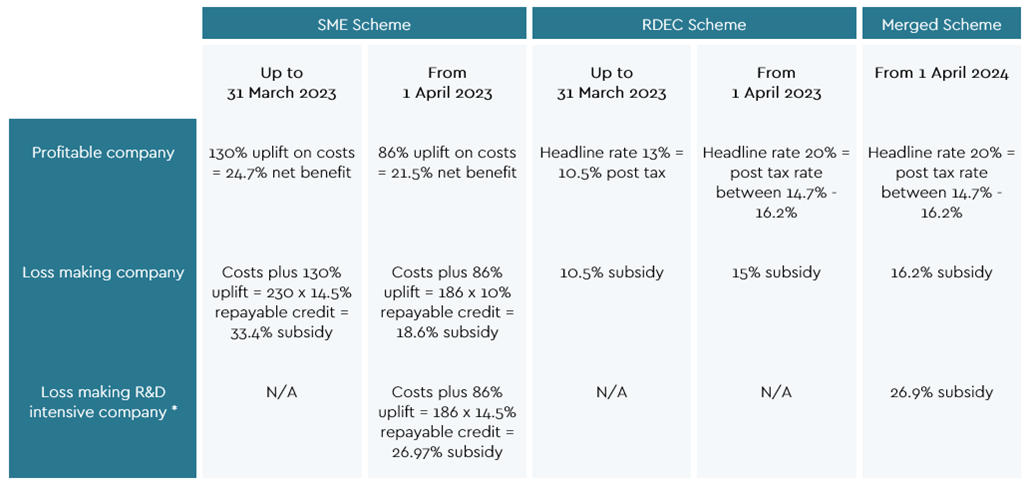

Below if a summary of the new R&D reliefs.

* For loss-making R&D intensive SMEs, following consultation, the R&D intensity threshold (proportion of qualifying R&D expenditure compared to total expenditure) to qualify as an R&D-intensive SME has been reduced from 40 to 30 percent for accounting periods beginning on or after 1 April 2024.

Merged Scheme

There will be a merged research and development expenditure credit (RDEC)-like scheme with all companies, regardless of size, receiving an above the line credit at the current RDEC rate of 20%.

For loss-makers, the notional tax rate applied to the R&D credit will be the small profits rate of 19% rather than 25%. This will mean the net benefit to profit makers is 14.7%-16.2, whereas loss-makers will receive a net benefit of 16.2%

The merged scheme will not employ the subsidised R&D restrictions from the current SME regime. Consequently, where a company’s R&D costs are subsidised, either via grant funding or R&D is funded by another person, there will no longer be the requirement to reduce the relief available to the company.

The merged scheme will adopt the more generous PAYE/NIC cap from the current SME regime.

SME R&D Intensive Scheme

The SME intensive scheme offers a higher rate of relief for SMEs that invest heavily in innovation.

The R&D intensity threshold (proportion of qualifying R&D expenditure compared to total expenditure) to qualify as an R&D-intensive SME has been reduced from 40 to 30% for accounting periods beginning on or after 1 April 2024.

Eligible companies will continue to receive an 86% enhanced deduction on their qualifying R&D expenditure and will be able to claim a repayable tax credit of 14.5%. Unlike the merged scheme, this credit will not itself be subject to corporation tax. This results in a potential net benefit of 26.9% of R&D qualifying expenditure.

The current SME scheme restrictions in relation to subsidised R&D will also be removed from the R&D-intensive SME regime for accounting periods beginning on or after 1 April 2024.

In addition, a ‘year of grace’ will be available to claimants which were ‘R&D-intensive’ in the previous accounting period but fall beneath this threshold due to a one-off event.

Other points

Remember for both schemes Overseas expenditure will not be eligible for R&D relief, except in very specific cases where the conditions necessary for the R&D are not present in the UK and would be unfeasible to replicate in the UK.

R&D Administration

1. From 1 April 2023, a company that has not claimed R&D tax credits in the past 3 years must notify HMRC of their intention to file an R&D tax credit claim within 6 months from the end of the period in which the claim relates. If this ‘advanced notification form’ is not completed, it will render any R&D claim invalid.

2. From 1 August 2023, HMRC has announced that all claims will be required to be made digitally, except for companies exempt from the requirement to deliver a Company Tax Return online. HMRC will require additional information to be submitted through a new online portal (separate from the main company tax return). If the additional information is not submitted or is not submitted in the correct format, it deems the R&D claim invalid.

3. The additional information form submitted via the portal will not replace the R&D claim on the company tax return; it is an additional compliance requirement.

4. Claims must contain a detailed report on the R&D project - including the name of the agent who has advised the company on compiling the claim. The claim must also include a breakdown of costs across categories.

Written by Jess Gray

jgray@critchleys.co.uk