What is it?

HMRC are implementing a point-based system for those businesses that are late submitting their VAT returns.

This will replace the existing default surcharge scheme, whereby penalties are charged as a percentage of the VAT liability for the period.

Further changes are being implemented concerning penalties for the late payment of any VAT liability.

How interest is calculated is also due to change.

Who is it for?

Anyone submitting VAT Returns for periods starting on or after 1 January 2023, including those that ordinarily submit repayment or nil returns.

How does it work?

Late submission of VAT Return

Every VAT Return submitted late will attract one penalty point, including repayment or nil returns.

It will also trigger a period of compliance during which all returns must be submitted on time to reset the points total to zero.

Further late submissions during this period will incur additional points and extend the period.

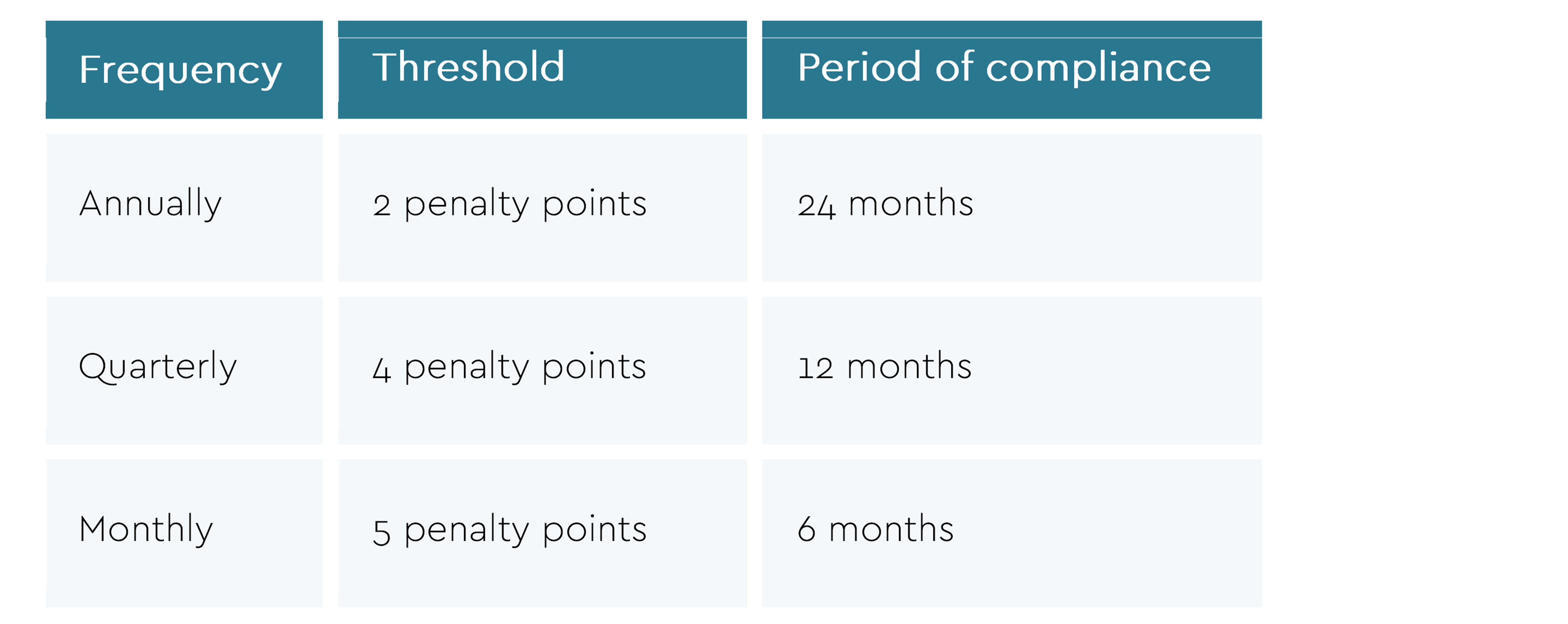

This period of compliance will vary depending on the frequency of your returns, as will the threshold at which financial penalties will be charged.

Once you reach the relevant threshold, you will receive a £200 penalty, followed by a further £200 penalty for each late submission during the compliance period.

Thresholds will be dependent on your submission frequency:

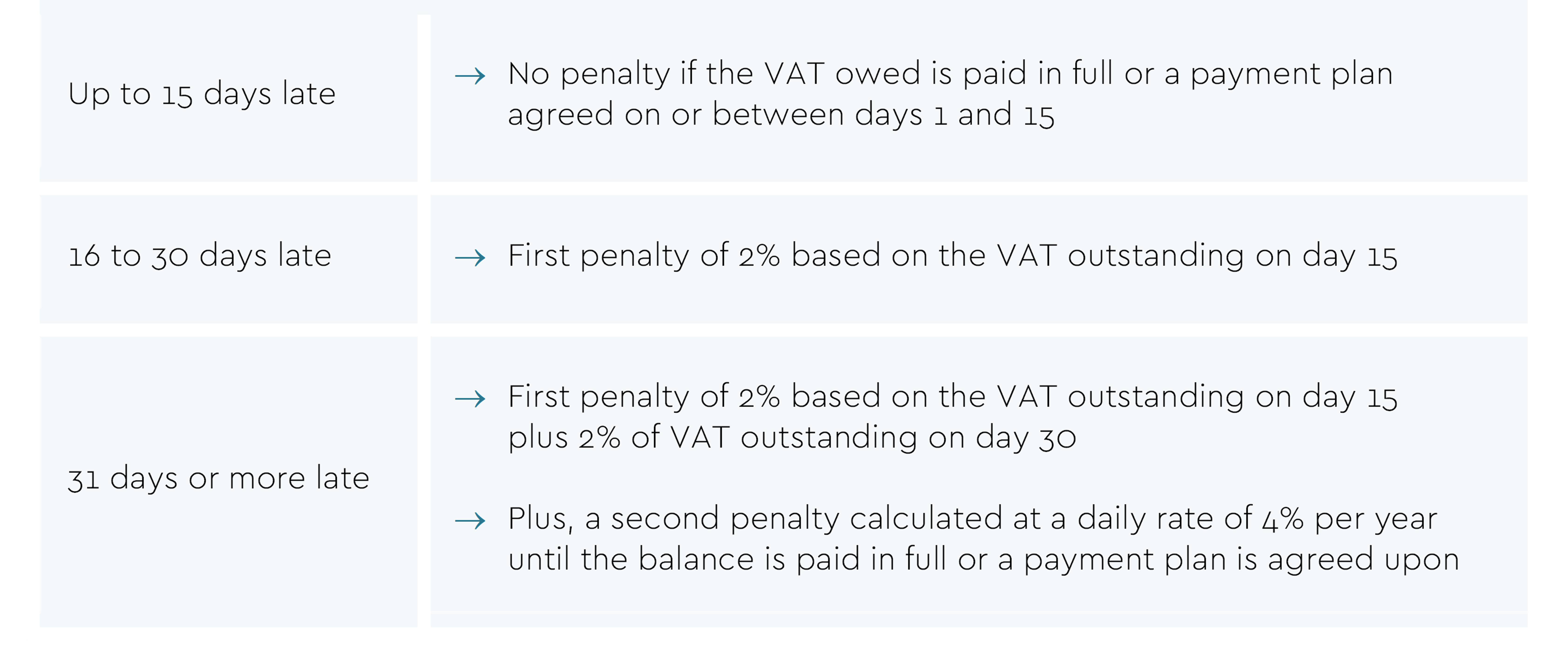

Late payment penalties

These are in addition to the penalties for late submission and will increase depending on the lateness of the payment.

HMRC will not charge a first late payment penalty for the first year if you pay in full within 30 days of the due date for your VAT payment. This is to allow you to get used to the changes implemented.

HMRC will not charge a first late payment penalty for the first year if you pay in full within 30 days of the due date for your VAT payment. This is to allow you to get used to the changes implemented.

However, from January 2024, you will receive the penalties from the day after the submission is due.

These penalties will apply in addition to late payment interest.

How late interest will be charged

Late payment interest will be calculated as the Bank of England base rate plus 2.5% from 1 January 2023.

HMRC will charge this interest from the day the payment is overdue until the liability is paid in full. Therefore, the sooner you pay, the lower the amount of interest you will need to pay.

Repayment Interest

HMRC are withdrawing the repayment settlement from 1 January 2023; therefore, for accounting periods starting on or after this date, HMRC will owe you repayment interest on any VAT owed to you. This will commence on either the day after the due date or the submission date until they repay you in full.

The lowest rate of repayment interest is 0.5%, even if the calculation of the Bank of England base rate of less than 1% is lower than that percentage.

What should I do next?

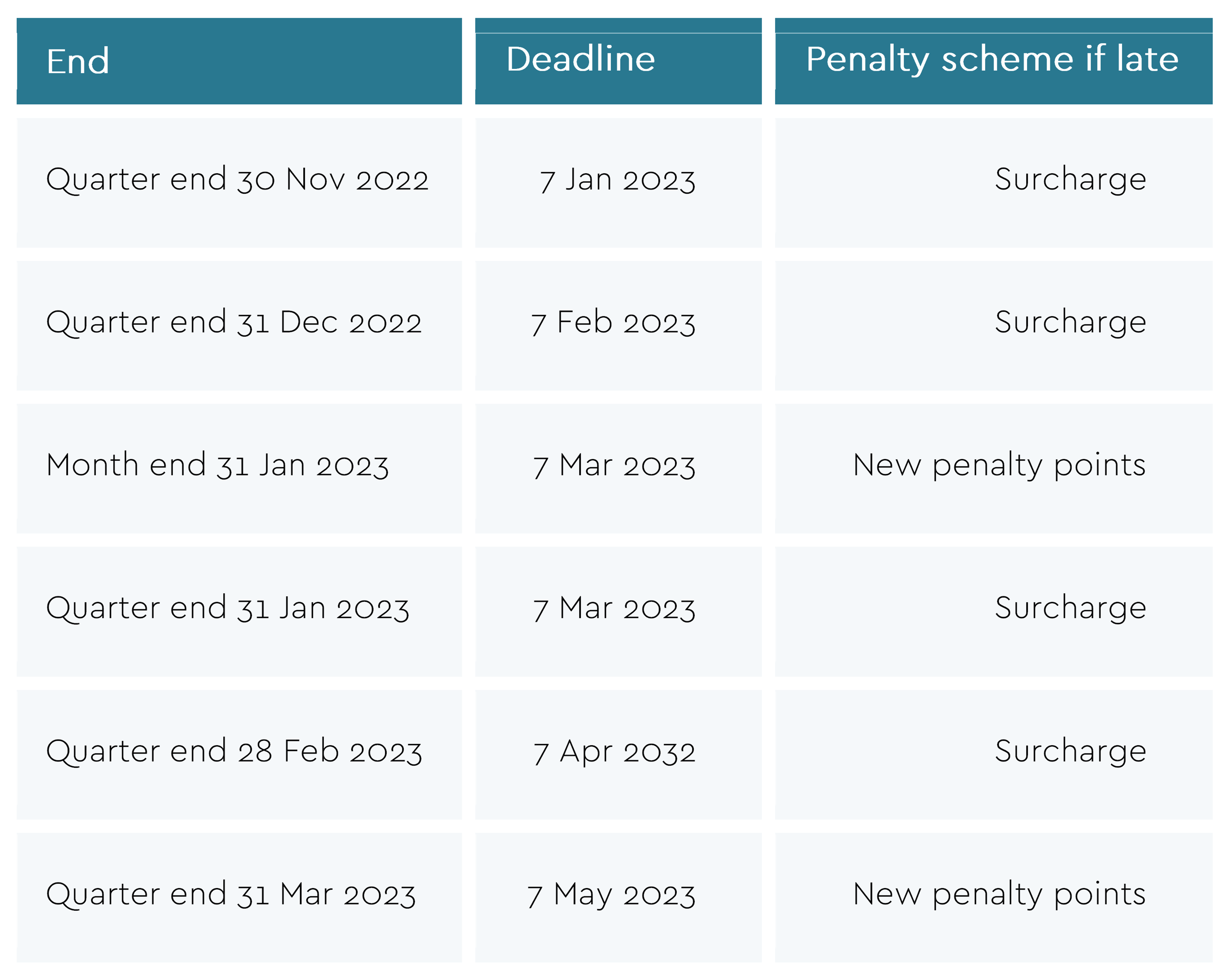

Ensure that all VAT returns covering periods to 31 December 2022 are submitted by the due date, and any earlier returns as soon as possible.

The penalty rate used will depend on your quarter end. See the table below for examples

If you have any queries regarding the above or have any other questions relating to your VAT returns. Please do not hesitate to contact a member of the Outsourcing team.

Find out more about Bethany Pankau